Colin Hampden-White Discusses Whisky Cask Investment in 2025

Colin Hampden-White, Keeper of the Quaich, gives insights on whisky as an alternative investment in 2025.

Colin Hampden-White

Table of contents

- Introduction

- Regulatory Changes: Warehousing

- Navigating Economic Challenges

- Trends To Look Out For in 2025

- Dos and Don'ts for 2025

- Conclusion

2025 presents an interesting blend of promising opportunity alongside market changes and considerations in the whisky cask investment world. Join Keeper of the Quaich, Colin Hampden-White, as he talks us though some key trends and considerations for 2025.

Regulatory Changes: Warehousing

Perhaps the biggest change for the cask market will come in 2025, with the recent announcement that from March 3rd, Owners of Warehoused Goods (OWG) will be removed from the Statutory Instrument known as WOWGR (The Warehousekeepers and Owners of Warehoused Goods Regulations 1999) – a layer of legal due diligence which HMRC is responsible for when vetting whether revenue trading businesses are operating within the law.

What do the current WOWGR regulations mean for cask owners?

Currently there are four types of cask owners that have casks stored at bonded warehouses:

- Private individual with an account at a warehouse but do not have a WOWGR licence, with the casks in their name. These individuals normally cannot be seen to be trading casks, but can bottle their casks for enjoyment or keep for a small alternative investment.

- Private individual with an account and a WOWGR license with casks in their name. These individuals can trade casks, but will also be subject to the relevant tax implications.

- Private individual without an account at a warehouse and do not have a WOWGR license, but own casks with a revenue trading cask business that have accounts with warehouses and WOWGR license. These individuals can have revenue trading cask business – like Cask Trade - trade casks for them, the registered trading business takes onus of the tax implications.

- A revenue trading cask business with accounts at warehouses and registered under WOWGR license. These are revenue trading businesses like Cask Trade, who own and store their own casks at warehouses and will be trading them for their own means.

The number of casks a private individual can own without being registered with a WOWGR license has long been a grey area. This has recently been cleared up by Alan Powell - Excise Duties Consultant at Alan Powell Associates; Founder and Co-ordinator of the British Distillers Alliance – and the main driving force behind the amendments to the regulations. Private individuals can own as many casks as they want without being registered under WOWGR, if they are for investment and not business purposes.

Currently revenue trading businesses like Cask Trade - who own and trade casks - have to be covered by a WOWGR license. Private individuals who want to trade their cask/s, need a trusted registered trading business with a WOWGR license to allow them to do so. Please consider for people outside the UK, they also need a duty representative around any arrangement for casks.

What do the changes to WOWGR mean for cask owners from March 3rd 2025?

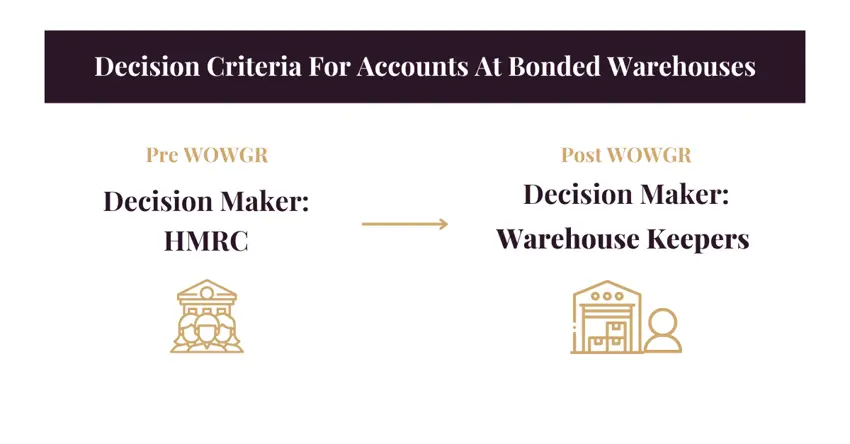

The changes to WOWGR removes the registered WOWGR license part of the regulations. This essentially removes a layer of legal due diligence that HMRC are responsible for. The onus will now solely be on the warehouse keepers to judge if a private individual or revenue trading business can open an account to store casks at a warehouse under their name.

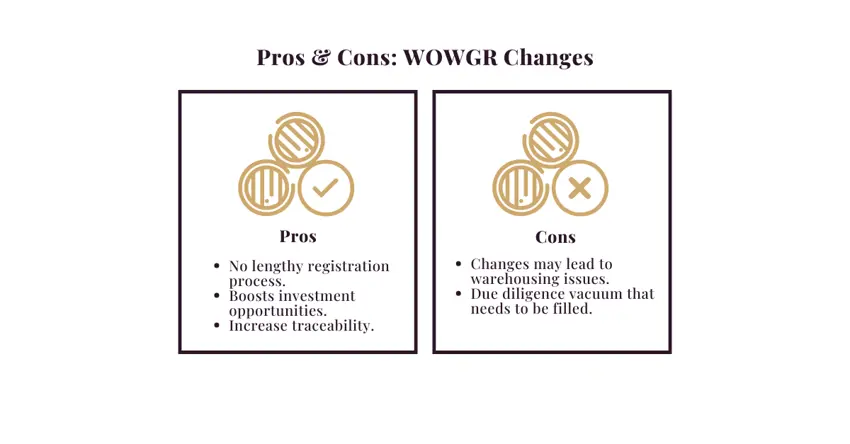

Some believe this may benefit cask whisky as an alternative investment marketplace, making it easier in principle to have direct ownership and transparency. But the move doesn’t change the fact that most warehouses will not have the capacity to administer multiple accounts for individuals under their own private name.

There are some warehouses that do offer this now and they will increase in number, however most warehouses are simply not going to open themselves up to what could be an hefty administrative load. People should be aware that there will likely be an elevated fee structure to accommodate this change across the industry.

Strong Industry Relationships Matter

Most cask businesses may have to offer this as a service moving forward. This means that some cask businesses - who have not built-up strong relationships with warehouses - could find it difficult to help their clients if they decide they would like an account at a warehouse in their name. This also opens an opportunity for warehouses who are willing to take on the large admin process, as they can charge for the service.

In practical terms, this change will bring the account holder closer to the warehouse. This could be for sampling, regauging, moving, re-racking into a new cask, or bottling.

At Cask Trade we are currently able to offer a delivery order to transfer the ownership of casks to any client that has an account at a warehouse. We can also continue to act as a custodian in any event, we are also accredited and act as a duty representative for all our clients oversees and this will not change in March 2025. Our cask management system will continue to offer options for clients as a trusted cask trading business.

In summary, the changes in WOWGR regulations mean warehouse keepers will be the sole judges of whether a private individual or business is legally reputable enough to open an account to store casks at a bonded warehouse – not HMRC. Currently the keepers are not set up to take on high volumes of account applications, therefore dealing with cask trading experts who have industry experience and relationships is good practice.

Navigating Economic Challenges

2024 has been the toughest year in a long time for the Scotch whisky industry. The Nobel & Co. annual Whisky Intelligence Report showed bottles of Scotch sold at auctions valued at over £1,000 slumped in value by 40%. Volume declined by 34% in the same period, illustrating that luxury has suffered the most in a period of decline for the overall Scotch whisky market since the heights of early 2023. This vast majority of decline in this sector has been in Macallan, which has seen a 51% decrease in volume.

But it isn’t all doom and gloom. The article Scotch on the Rocks?, in the latest edition of Beyond The Cask – Cask Trade’s annual marketplace review – reported that according to issue 375 of Alan Gordon’s Whisky Newsletter – in 2024’s first four months to April, export volumes were still higher than the same period in 2021. It also discovered that historically, slumps are expected post-recession and that the post covid market, alongside hikes in duty, has exacerbated this effect in the UK.

Volumes weren’t the only thing that returned to the pre covid norm, so did specialist whisky retailers’ sales. Many reported that the price consumers are willing to pay for a slightly pricier drinking whisky is back to around £75, down from the brief height of £100 in 2023.

Hikes in prices have driven whisky fans to discover historically lesser-known and more competitively priced distilleries such as Ledaig, Bunnahabhain, Glenallachie, Glen Moray, and Glen Garioch. This has created a resilient middle market, where a return to a more moderate pre 2021 growth means the long-term picture remains positive.

Some are also looking outside of whisky, rum has been a favourite with independent bottlers for its rich tropical flavours, but Armagnac also saw an uptick last year with vintage casks at more approachable prices than whisky.

Cask Trade are well prepared for the current whisky trends.

In 2023, CEO of Cask Trade – Simon Aron – believed that these wider market changes would create a period of consolidation in the cask marketplace. This proved to be the case, and in 2024 it became a buyer’s market, where new make from distilleries with provenance are the most sought-after casks for their long hold potential.

This foresight enabled Cask Trade to commit to sourcing strong new make across distilleries with provenance. Building on what is already the biggest and most diverse cask stocklist in the market. That includes Scotch whisky, rum, Cognac, and Armagnac.

The long term picture of the whisky market remains positive, with a return to a more moderate growth across a middle market that has more variety in distilleries. Building a diverse long hold portfolio with provenance is the appropriate approach to cask ownership in these conditions.

Trends To Look Out For in 2025

Trends to look out for in 2025 include the continued growth of Scotch whisky in developing markets such as Turkiye, Brasil, and India. Where strong advocacy and investment from Diageo and Pernod Ricard is making the most of this opportunity.

Macro-economic factors have a big influence - Spain upped its Scotch whisky imports in the same year that it was named the strongest economy in the world by the Economist magazine. On the other hand, China is facing economic slowdown which, as NBC News reported last year, is driving “reverse consumerism” trends that have seen consumers turning to lesser known brands for value and quality over big brand names. This is being reflected with Scotch whisky imports and trends, meaning whisky drinkers in China are discovering a wider range of distilleries to enjoy. Cask Trade’s account manager in Hong Kong, John Wong, has observed that whisky fans are discovering their favourite flavours in previously lesser known distilleries such as Ardmore, Bunnahabhain, and Ledaig.

All of this reinforces the need to search for diversification in a cask portfolio. It also places importance on research, if the trend in Asia is for sweet and fruity forward whiskies with a touch of smoke, what distilleries are delivering these profiles?

Read more about international trends in our summary of the Scotch Whisky Association Export Figures Report 2024.

Do and Don’ts for 2025:

Dos:

Research and thoroughly compare any cask company you are thinking of purchasing from to ensure three years of solvent and up to date accounts at Companies House. In addition to pricing, legitimacy, business practice, accounts, office locations, and company history.

Think of your purchase as a long hold the current market has returned to a more modest growth rate, as explained in Hold on Wait a Minute and Should I Buy a cask in 2025? - articles which are published in our annual cask marketplace report. Register to access the full publication. Remember, buy with provenance and be prepared to wait.

Build a diverse portfolio. Think about hold time and budget, then look at different distilleries and age statements, different wood types, regions, and countries.

Ensure a thorough understanding of your exit options. Whether it's independent bottlers, Auction Your Cask, third party sales, discretionary buy backs, or bottling yourself.

Always check a cask’s naming rights.This will effect its value and the options for bottling.

Don’ts:

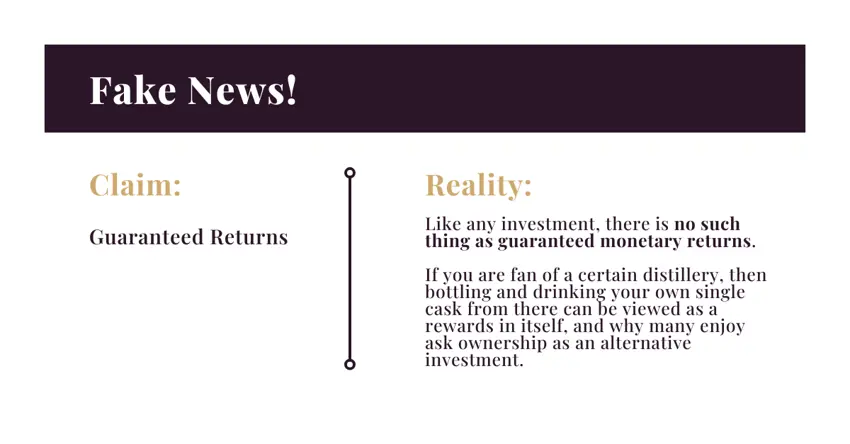

If it sounds too good to be true, it probably is. Don’t be drawn in by companies who promise quick or guaranteed returns, or quote massive profits from examples of old and rare casks.

Buy casks from companies that don't have the correct licences or accounts with a warehouse to store whisky casks.

Buy multiple cask from the same year and distillery. If you are buying multiple casks, always diversify with different distilleries and age statements. This minimises risk and gives more flexibility.

Spend what you can’t afford to lose. Investing always has risks, make decisions with care and responsibility. Your account manager should always ask what your budget is before proceeding with any conversations.

If you want to learn more about where to start with cask ownership, read our Beginner's Guide to Whisky Investment, where we discuss cask investment considerations in more detail.

If you are interested in exploring cask ownership as an alternate investment, choosing a cask stockist such as Cask Trade can greatly help you make well informed choices based on the market trends discussed in this article. They pride themselves on making whisky cask investment an accessible and enjoyable process.

Their whisky experts hold a wealth of knowledge between them. Not only are they experts in the market, they have a true passion and understanding of the liquid.

Read Cask Trade's marketplace report

If you would like to learn more about the cask whisky marketplace, download a copy of Beyond the Cask, our annual whisky report.

Register to start your cask ownership journey

If you have decided that whisky cask ownership is for you, or want advice about how to get started building a portfolio, register today to speak to one of our experts. Once you register you will be assigned a dedicated account manager, gain access to our exclusive stocklist, and personalised advice and support.

Based in Hong Kong?

With experts across the globe, we can help you no matter where in the world you are. Register on casktrade.hk to speak to our Hong Kong based team.