Is Whisky A Good Alternative Investment? Lets Explore...

What makes whisky investment interesting? Let’s explore the key reasons why whisky cask investment should be on your radar.

Cask Trade

In the world of alternative investments, cask whisky has emerged as one of the most engaging and tangible opportunities. With a proven track record of appreciation, growing global demand, and the prestige of owning a piece of history, cask whisky is proving a popular addition to a diverse portfolio.

But what makes whisky investment interesting? Let’s explore the key reasons why whisky cask investment should be on your radar.

Table of contents

- Consistent Appreciation Over Time

- Tangible Asset With Intrinsic Value

- Growing Global Demand

- Protection Against Inflation and Market Crashes

- Supply and Demand Economics

- Tax Advantages

- Portfolio Diversification

- Sustainability & Ethical Investment

Consistent Appreciation Over Time

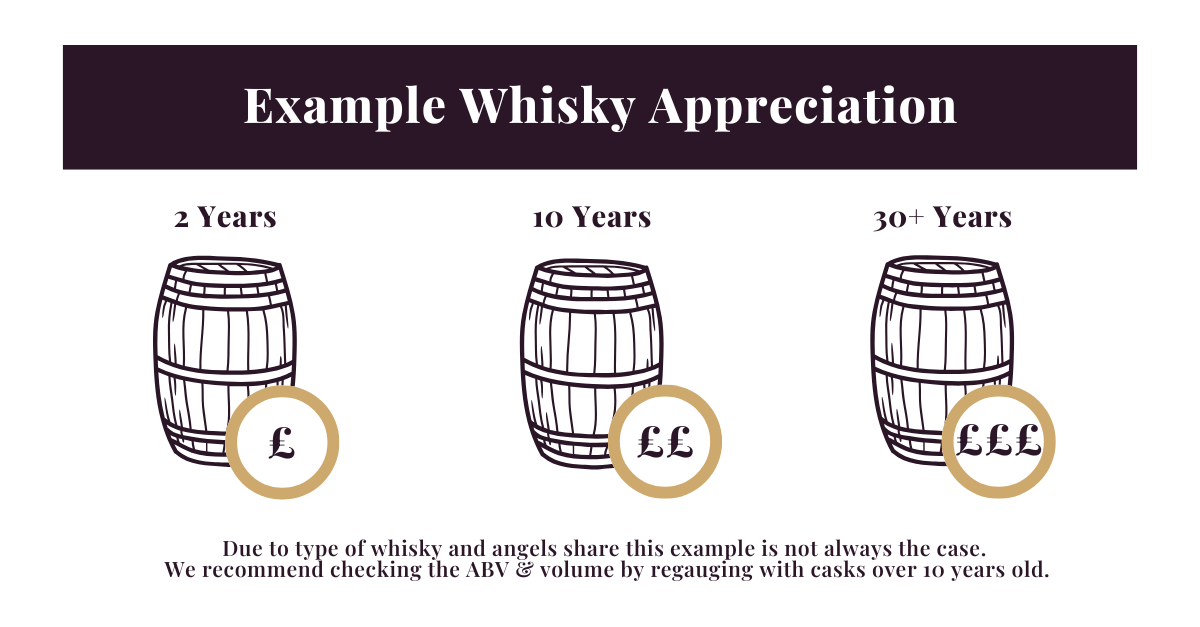

One of the biggest appeals of cask whisky is that its price appreciates as it matures. Whisky is uncomplicated in its pricing, younger whisky from a distillery is less expensive than older its whisky. Most whisky is bottled at younger ages to make it more affordable and to meet demand for the product, this is the reason a 12-year-old whisky costs less than an 18-year-old whisky.

Using the same logic, a younger cask of whisky is less valuable than an older cask. Over a five year plus ownership, you would therefore expect to see the value of a cask increase. This is especially true for ownership over ten years.

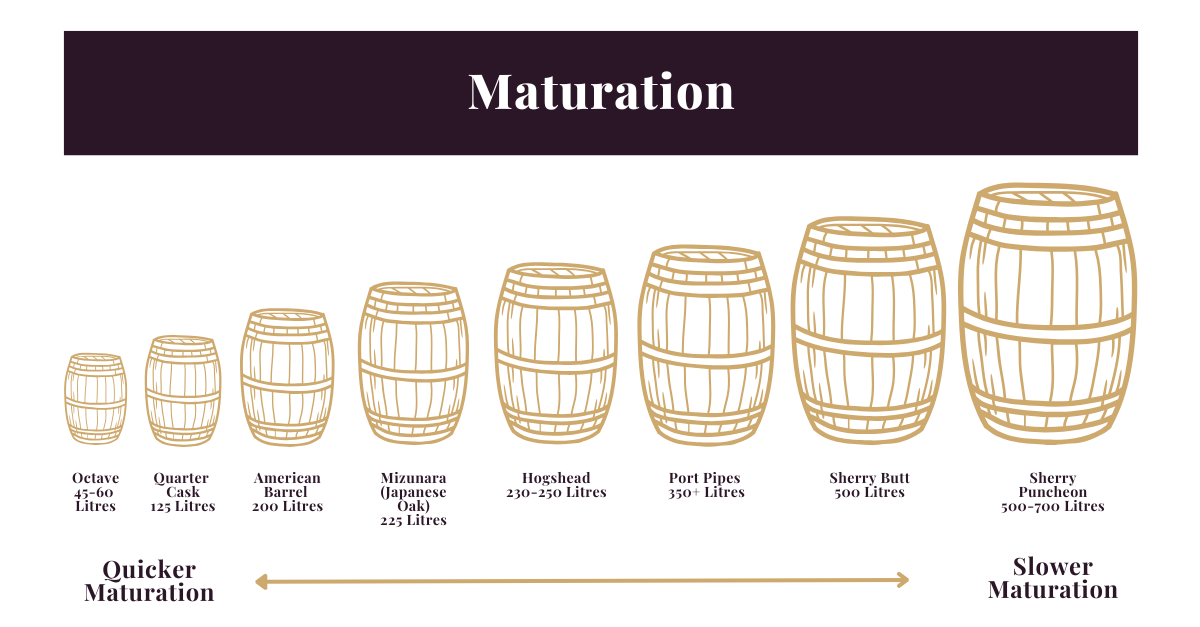

Whilst it is true that most older whiskies are more valuable than younger ones, cask health checks are essential. These determine the ABV and liquid quality as the whisky matures. New make whisky (less than three years old) starts its life at approximately 63.5% ABV after distillation. As it matures, this % decreases due to the natural evaporation process, known as the ‘angels share’. As the cask reaches its latter years, health checks are essential to ensure this % doesn’t drop below 40%. If it does, it cannot legally be called Scotch whisky and up to 95% of the value cab be lost. Read more about the maturation process here.

Tangible Asset With Intrinsic Value

Whisky is a physical asset, meaning it isn’t subject to the same volatility as digital or paper investments. Stocks and bonds fluctuate in quite short periods of time, whilst whisky fluctuates over longer periods. With this longer fluctuation period, longer hold periods are better for mitigating risk. The maturation of the liquid inside the cask cannot be reversed, therefore value fluctuations are more likely to be impacted by wider market trends, or if the liquid is aged for too long.

Growing Global Demand

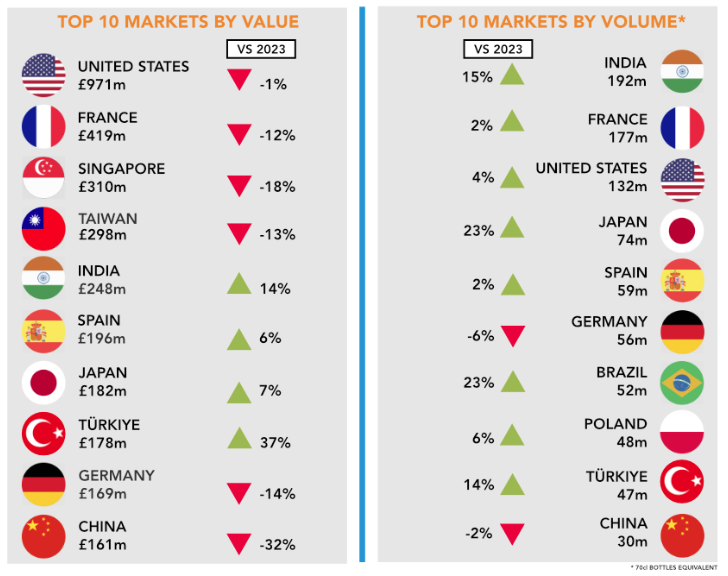

Global demand is a relative term. Firstly, we must ignore Covid 19 which saw an uncharacteristic inflation of growth in comparison to longer term historic trends. While a post COVID drop was experienced, whisky sales globally are still higher than pre-Covid 19 levels, suggesting a continual upward trajectory.

There are traditional markets like France and the US where whisky sales have decreased. These markets are very mature markets, with a poor economy and tariffs affecting whisky consumption respectively. But there are developing markets which are compensating for this. These developing markets are countries which are not just doing well with whisky sales, they are faring better in downtimes. They only at the beginning of their whisky journey, with many of them only consuming whisky domestically in the last ten to fifteen years. Türkiye is a great example of this, exports of Scotch to the country grew 14% in 2024. Many of these markets have different taste preferences to western markets and it takes time for new flavours and products to grow in those markets. Overall, the future in emerging markets is exciting.

Read the Scotch Whisky Association’s (SWA) export figures for more information about global market trends.

Protection Against Inflation and Market Crashes

Like many alternative assets, whisky tends to perform well in an economic downturn or when traditional investments are not doing well. The main difference with whisky is that it is a tangible asset. It will always have a value unlike stocks and shares which can fail completely and over a relatively quick period. This makes whisky a good hedge in a larger portfolio of investments.

Supply and Demand Economics

Whisky production is a time-intensive process, often taking decades to mature. With younger whiskies being bottled as the whole matures the aged whisky becomes rarer and the demand for well-aged whisky is increasing.

Tax Advantages

At the moment, the profit made from cask whisky is capital gains tax free as the liquid inside the cask is considered a wasting asset. This is due to the evaporation process over time reducing the volume of liquid as it matures in the cask. Currently you won’t pay capital gains tax on money made at the point of sale, providing your cask doesn’t leave a bonded warehouse over the duration of time that you own it. Those living outside of the UK should check their local tax rules. This gives a particularly good incentive versus other assets which do not benefit from this tax advantage.

Portfolio Diversification

Adding whisky to your investment portfolio can enhance diversification, reducing overall risk. This statement is also true within a whisky portfolio. A portfolio of casks which have a range of distilleries from different regions, ages, hold times and cask types will, overall, perform better than the majority of portfolios with a great deal of one product. The simple observation that multiples of one thing cause greater supply and therefore satisfy demand makes it obvious that a diverse portfolio is a good thing. Diversity also extends to an exit plan. Having multiple exit plans for multiple casks is also a benefit. Whether that exit is at auction, to bottle the whisky, or place it on consignment, having as many options as possible is a positive.

At Cask Trade, we never sell by the pallet and wouldn’t recommend a private client (buying casks for yourself rather than to bottle and sell) to buy multiple of the same cask. Read more about what to consider when building a diversified whisky portfolio here.

Sustainability & Ethical Investment

The whisky industry is progressively moving towards sustainability, with many distilleries adopting eco-friendly production methods. From heat exchange systems to biofuel and technological advances, the whisky industry is moving forward towards net zero, with some distilleries already performing at net zero already.

Conclusion

Whisky investment is more than just a trend—it’s a time-tested strategy with strong historical performance and future potential. With growing global interest, finite supply, and a reputation for stability, whisky presents an exciting opportunity for investors looking to diversify their portfolio with a tangible, appreciating asset.

If you’re interested in learning more about cask whisky investment, register to speak to our experts today or read our guides here. We can help you navigate this fascinating market and secure premium whisky casks with strong growth potential.