Collectable Whisky Brands

A comprehensive insight into collectable whisky casks and bottles.

Cask Trade

Table of contents

- Whisky For Collectors

- Are Different Types of Whisky More Collectable Than Others?

- What Brands Are The Most Collectable?

- Does The Whisky Age Affect Collectability?

- Which Whiskies Are Growing In Investment Popularity?

- Do I Invest In A Collectable Cask or Bottle?

- Is There A Best Time to Invest In Whisky?

- How Do I Start A Whisky Collection?

Whisky For Collectors

In this guide we will review the concepts of collectable whisky compared to investment whisky and look into how you might go about deciding what to collect or invest in.

There are two main types of whisky investment or collection options: casks and bottles. Bottles come in two main types and can have a great deal of cross over. There are bottles collected by whisky fans which may be collected because of brand, or distilled in their birth year, or perhaps the type or style of whisky. There are also whiskies collected with the speculation that they will increase in value over time and can therefore make a good investment.

Casks, on the other hand, aren’t typically ‘collected’. Whisky casks fall into the category of alternative investment, meaning those who purchase a cask will hold it for several years and then realise the profit when the cask has matured and the liquid itself is more valuable. While we don’t tend to group casks under ‘collectables’, it is true that investors may own a wide portfolio of casks to diversify the hold times and investment potential of their alternative assets.

Are Different Types of Whisky More Collectable Than Others?

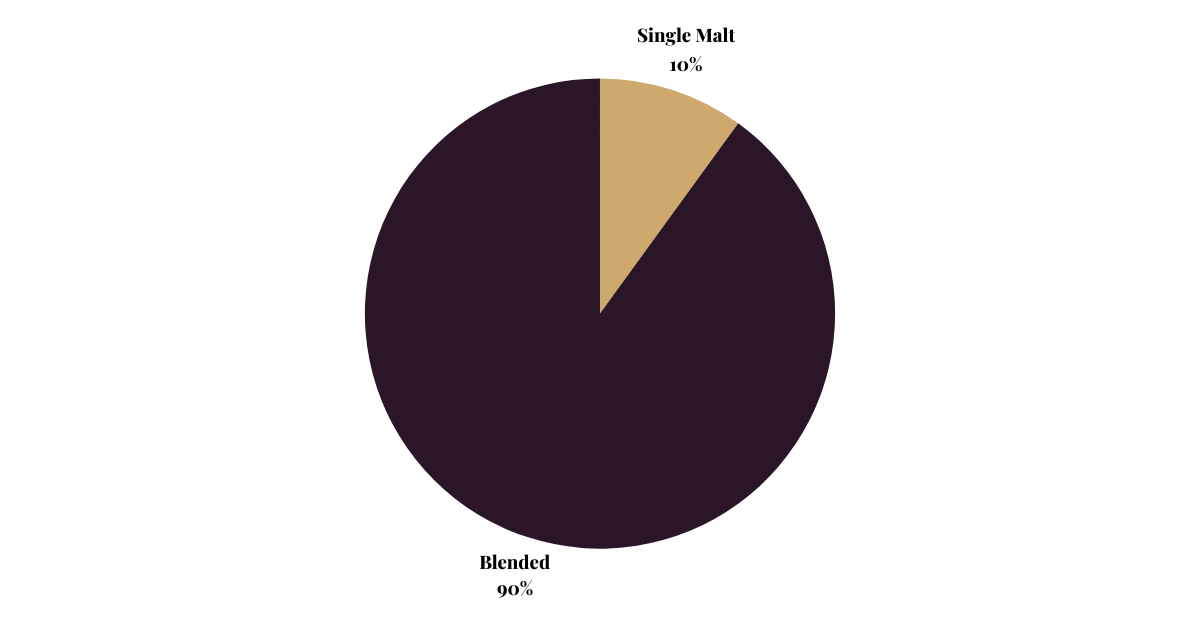

There are two main different types of whiskies to collect. Single Malts (a malted whisky from a single distillery), and blended whisky (grain and malt whisky from multiple distilleries). Single malt is now viewed as the most prestigious Scotch Whisky with brands including Glenfiddich, Glenlivet and Macallan. They sell all over the world and can cost from as little as £25 in a supermarket to as much as £1.2M for a unique bottle at auction.

Blended whisky is a mix of grain and malt from more than one distillery. 90% of the whisky consumed in the world is blended whisky, the biggest brand being Johnnie Walker, and other popular brands being Chivas, Ballantines and Dewars.

Blended whiskies used to be considered inferior to single malts, however this isn’t the case, and many blends cost upwards of £100 and can be as much as £100,000.

Neither of these whiskies are intrinsically more collectable than another and depends on the rarity of the brand or bottle. A blended whisky from the 1950’s from a good brand might be valuable as there won’t be many bottles left undrunk from that period. Conversely, a single malt whisky from a big brand name which can be found in a supermarket will be plentiful, not in demand and therefore not worth more than its retail price. Read more about how the variety of whisky impacts it’s worth in our Types of Scottish Whisky Guide.

What Brands Are The Most Collectable?

There are brands which have become more collectable than others. The Macallan for example has become a globally collectable brand for their limited-edition whiskies. The Macallan is a heritage brand with great history and a large loyal following. There are new brands which are collectable, if more speculative. The don’t have the history of a brand like The Macallan but are made in small quantities and have a very loyal fan base. A good example of this would be Dornoch distillery. They only produce a tiny number of bottles each year and have to be sold by ballot.

A good rule of thumb is that if you can find a whisky from multiple retailers at the same time, at the same price, then it probably isn’t very rare and therefore unlikely to be investable in.

The three brands getting the most attention from collectors at the moment are: Springbank, Rosebank and Brora, though this may change in the future. Interestingly Springbank produces small amounts of whiskies and Rosebank and Brora were closed distilleries, but very recently these distilleries have been resurrected. It is the historical bottles of whisky (distilled before their initial closure) which will hold the highest value.

Does The Whisky Age Affect Collectability?

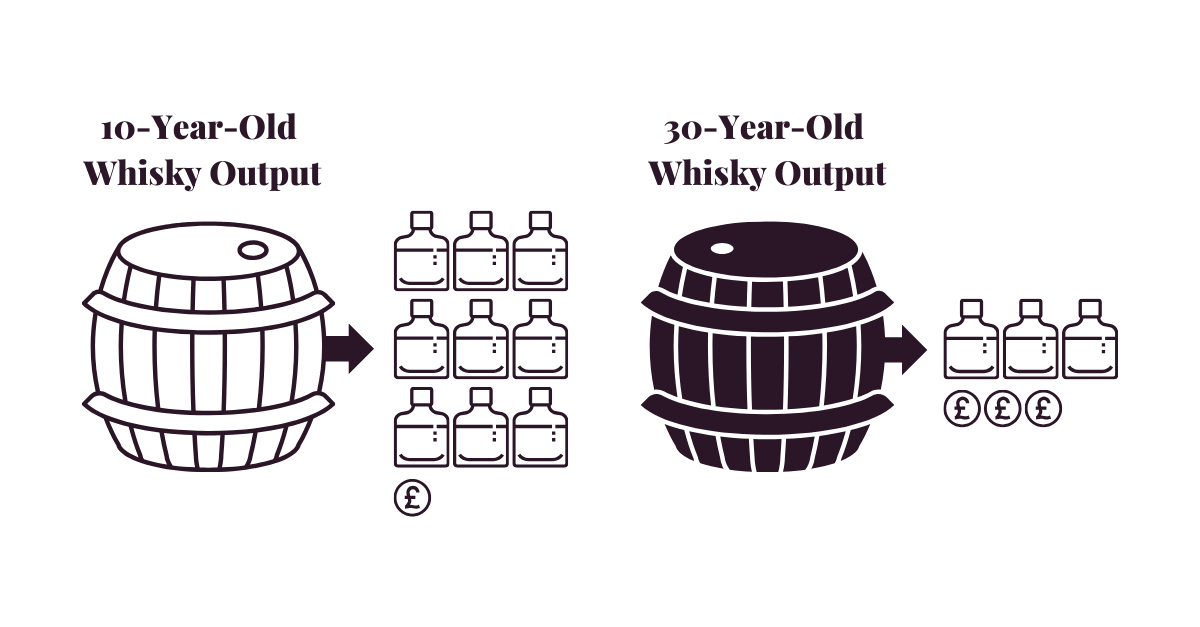

The age of the liquid influences both whisky for collectors and cask investors. When looking at bottle age, often there will be less bottles of older whiskies. Whisky loses volume in the cask as it ages, so a cask of 10-year-old whisky will yield many more bottles than a 30-year-old cask of whisky. There is also rarity created as not so many casks will make it to 30 years or more without being bottled. For example, a bottle of 12-year-old Glenmorangie which is plentiful is unlikely to increase in price over a 25-year-old Pommard finished Glenmorangie, where only 1000 bottles were produced for the world market.

Cask age, on the other hand, influences cask value and investment choices in different ways. A new make cask (younger than three years old) will inevitably be cheaper than an aged cask which is ready to be bottled. However, investors who have the time to wait for maturation may prefer to invest in a younger and cheaper cask, meaning they might gain greater return on investment but over a longer period of time. Others may be more interested in old and rare casks with a higher value as they are either looking to bottle and sell for their own brand, or simply want the privilege of owning a specific cask and enjoy the liquid themselves.

The age of the liquid therefore impacts the buyer depending on their goals. However, age doesn’t solely dictate value – trends in line with the market and brand scarcity all interlink and can impact whisky value alongside age.

Which Whiskies Are Growing In Investment Popularity?

Whiskies maturing in casks are growing in popularity. As more people understand the difference between collecting and investing in bottles of whisky, cask whisky investment is becoming more popular than investing in luxury whisky brands. In cask, single malt whiskies are still the most popular to invest in. With so many different brands and distilleries to invest in, having a good guide to navigate them is important. Our guide to Scottish Whisky’s goes into more detail about the nuances of different types of whisky and the regions.

However, in the world of bottled whisky, those produced by independent bottlers are becoming ever popular. Independently produced bottles of whisky tend to be less expensive that their official counterparts and are seen to be purer expressions of the liquid as they tend to be bottled at cask strength and are not coloured or chill filtered. Many of the independently bottled whiskies are from single casks, meaning that the numbers of bottles are extremely limited. This limited number brings rarity and for the best distilleries, like Ardbeg, or Springbank, there is also high demand.

Do I Invest In A Collectable Cask or Bottle?

If you are considering some form of whisky ownership, it is key to remember that bottle collection and cask investment are two different methods of owning whisky. Both can be used as a form of alternative investment, but to suit different investment goals.

Investing in bottles

Bottles are often cheaper than casks, meaning you can gain a greater variety of liquid compared to casks. Other benefits include no storage fees (providing you can keep your bottles at home), as well as the instant gratification of accessing you whisky bottles immediately. From an investment perspective, bottles can also be sold on quicker as the liquid has already matured.

However, the halting of liquid maturation can also hinder investment potential. Once in the bottle, any increase in value is dependent on market trends and bottle scarcity which cannot be guaranteed. Accessing high worth or rare bottles can be difficult. It often required a good history of previous purchases and a strong relationship with the retailer and many of the rarest bottles will be sold on allocation.

Investing in casks

In terms of investing, there are many pros to cask ownership. It is a capital gains tax free method of alternative investment, while also offering simple storage and maintenance. Due to the natural maturation of the whisky, the liquid increases in value over time offering return on investment potential (while bottles are reliant solely on market trends). Investing in casks is also an accessible method of whisky ownership and doesn’t require one to be an expert, especially with the support and guidance from experts such as ourselves.

For more help in weighing up the pros and cons of each investment, read our guide to Bottles vs Casks.

Is There A Best Time to Invest In Whisky?

There is no time like the present when investing in whisky. The market is constantly changing and short-term trends shouldn’t inform long term decisions. For example, the values of casks in 2022 were higher than 2024. So, if a cask was bought in 2022 then it shouldn’t be sold in 2024. That same cask valued again after 10 years in 2032 would more than likely be more valuable than it was in 2022, even if the market fluctuates.

This demonstrates the power of a longer hold time. While it is impossible to pinpoint the ‘best time’ to invest, it is certainly a good idea to start your cask ownership journey sooner rather than later if you have the time and budget for a longer-term investment.

How Do I Start A Whisky Collection?

When starting out in whisky, it can be very easy to take the advice of friends already in the industry. While this may be useful, it is always recommended to do your own research before committing to any form of investment. What might be a fantastic purchase for one person may not serve the interests or aspirations of someone else.

Define your budget and goals

How much are you willing to spend and are you expecting a return? If you are looking to realise money in the future, cask whisky investment is likely more suited. However, if you want to enjoy the whisky yourself or perhaps have a smaller budget, starting a whisky bottle collection could be better suited. More information on outlining you budget and goals can be found in our Beginners Guide to Whisky Investment.

Research

Utilise all the resources you can. There is a goldmine of information online. Some must be read with caution, but websites such as the Whisky Hunter is a great place to start for historical prices at auction for whisky bottles. Alternately, speak to a cask specialist who can talk you through the ownership process and how to get involved. Our expert team are here to help if you choose cask whisky investment.

To conclude, whisky investment and collecting whiskies are two separate activates. While there can be crossover, they primarily serve different goals and interests. Whisky cask investment is usually for those who want an alternative way to invest their money, while building a whisky collection is often more suited to those wanting to enjoy the liquid itself. However, that is not to say that money can’t be made from buying and selling bottles. Both lines of whisky ownership can be influenced by market trends and brand scarcity. If you are looking to get involved or need help defining your goals, register to speak to one of our whisky experts who is best placed to guide you through the process and find the best whisky for you.

Based in Hong Kong?

With experts across the globe, we can help you no matter where in the world you are. Register on casktrade.hk to speak to our Hong Kong based team.