Building a Diversified Whisky Portfolio

Find out what it means to build a diversified whisky portfolio and why this is important when considering cask whisky ownership.

Cask Trade

Table of contents

- What is a diversified whisky portfolio?

- Why does portfolio diversification matter?

- What factors affect whisky value?

- Our tips for a balanced portfolio

- What to avoid when building a diversified whisky portfolio

What is a diversified whisky portfolio?

Building a whisky investment portfolio can be beneficial for whisky cask owners. A diversified whisky portfolio means owning several casks with different characteristics. Variation between the distillery, age, and size of cask will provide portfolio diversity compared to owning several casks of similar origin or age.

This blog will discuss how to build a diversified whisky portfolio. It will explore what diversification means, and which parameters need to be considered to build a diversified portfolio and why this can be beneficial for cask owners.

Why does portfolio diversification matter?

With any alternate investment market trends can fluctuate, which may impact a cask’s desirability though distillery provenance, market saturation, and wider economic factors. Buying multiple casks of the same type may put your portfolio at risk if the whisky market changes. A diversified portfolio is therefore important, so that potential market fluctuations are less likely to impact everything you own.

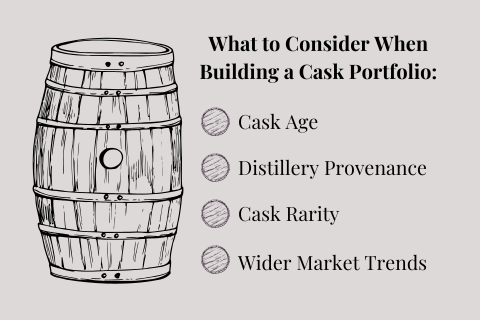

It is important to remember that there isn’t a single best whisky for portfolio diversification, but the following factors should be considered when looking to build a cask portfolio:

Cask age

As a cask ages the liquid matures and it becomes more desirable. Popular ages to bottle include 12, 15, 18 and 21, but you may sometimes see younger age statements. Investing in different cask ages means your casks will be ready to sell or bottle at different times, helping to diversify your investment hold times. This helps to mitigate market fluctuations at any one time. If you own three 12 year old casks and are trying to sell them at a time when the market is slow, you may struggle to find a buyer. Varying your cask ages means you have opportunities over a wider timeframe to sell on and realise profit.

Distillery

Over-reliance on a single distillery can be risky for a number of reasons, such market popularity and rarity. A certain distillery may produce very sought after casks in low volumes, which would initially indicate high desirability and good potential to sell in the future. But if this distillery were to start producing high volumes of casks, the rarity of the cask owned would decrease alongside the demand, due to there being more liquid in the market. If a distillery shuts down and stops producing liquid, this can positively impact the value of your cask. Diversifying across distilleries is advised, because these changes are extremely hard to predict.

Cask popularity

Popular distilleries and cask finishes will change over time, 10 years ago big names such as The Macallan were highly sought after for their provenance. Lately we have seen the market shift towards those distilleries who traditionally didn’t have as much brand equity, such as Glen Garioch, Ledaig, and Bunnahabhain. This illustrates that what is ‘popular’ at one point may change in the future, which is especially important when considering long hold casks.

Wider market trends

External factors can also have an impact on your portfolio. The cask marketplace saw a boom after the 2020 COVID-19 pandemic due to individuals spending at a lower and having more dispensable income. This boom raised the popularity of cask investment and meant there was more demand, leading to casks increasing in price. While this may have benefitted those looking to sell their cask through this time, there is no certainty that other external factors may impact economic trends which have a knock in effect of cask popularity and price. For this reason, a diverse portfolio across different distilleries and ages means you maintain flexibility in when you sell your cask and who it may appeal to.

When to diversify your portfolio

Diversification can be built into a portfolio at any stage. At Cask Trade, we have sourced whisky and rum casks from over 170 distilleries, meaning there is always variety of distilleries, ages, and value on our stocklist. If you are looking to build your whisky portfolio, we can work with you to define you budget and goals, matching a variety of casks to your individual needs.

What factors affect whisky value?

There are two main factors which effect a whisky’s value. Distillery popularity, rarity, and age. If possible, it is good to have a range of distilleries and ages. A portfolio can have a base of aged popular whisky, but this should be mixed with other distilleries and various aged whiskies.

The impact of cask age

Removing the value that brand equity provides a cask, the age of a whisky determines its value. An older whisky will be more valuable than a younger whisky from the same distillery, this is one of the reasons cask ownership is considered a long hold. Factoring in brand equity, younger whisky from a rare or in demand distillery can often be more expensive than an old whisky from another distillery.

Owners should be aware that if a cask matures for too long and falls under 40% abv, it cannot be called whisky and can lose up to 95% of its value. Trusted cask management is therefore important to help monitor the health of casks that are above 10 years of age.

The impact of cask rarity

Rarity can give great value and can come in the form of both distillery rarity as well as specific cask rarity.

There are distilleries whose whiskies are hard to find, like Ardbeg for example. These whiskies will always hold a premium. Established distilleries will be more stable than new boutique distilleries, as the new boutique distilleries are yet to be long term tested in the market. Even if those new distilleries have become trendy in the short term, rare and established distilleries will always hold the greatest value.

Casks from rare distilleries can be further enhanced by having unusual oak used in their maturation. A popular distilleries whiskies matured or finished in Japanese Mizunara oak can hold a premium, whilst whisky matured in ex sherry casks are more expensive than those matured in ex bourbon casks due to size, and supply and demand.

Scotch vs the rest of the world

There are differing styles of whisky from different countries. There is a lot of variety in the types of Scottish whisky that you can invest in. However, other regions offer interesting diversification when building a portfolio. Irish whisky, being mostly triple distilled is more delicate than scotch, and Japanese more precise. Where possible it is a good idea to hold a small number of whiskies other than Scotch. For example, Welsh and English whisky offer an interesting alternative.

Our tips for a balanced portfolio

When deciding on your whisky portfolio strategy, there are a few things that we recommend you consider:

Tip 1: Budget

The first factor is budget. Of course, with a minimal budget one can only buy one cask, but if there is a budget for more than starting with two casks from two different distilleries would be a basic start. If there is more budget, then differing ages can be looked at before exploring further distilleries.

Tip 2: Investment goals

The goals of the investment are important to know. How long is the investment for is very important. The style, type and distillery are less important in terms of the length of investment. The age of the whisky is very important. For longer term investments, younger whisky is always going to be better, unless a particularly healthy cask which has age can be sourced. For short term investments, older whiskies will be better. The difference in value between a 15 and 18 year old whisky for example will be considerable.

Tip 3: Passion vs profit

When investing, the fun and passion should be included if possible. Within a diverse portfolio it is good to include whiskies that you, as the investor, likes. Samples can be drawn and tasted as the whisky matures. Even if the portfolio only holds a few casks, as long as the investment term is long, a cask of something you like can make the ownership journey interesting and more personal.

Tip 4: Selling vs. Holding

When to sell and hold is crucial. Cask trade will be able to determine the factors in making these decisions. They will be able to advise a hold when the market isn’t favourable for selling, and to sell if the whisky is fully mature and needs bottling. Whisky which reaches its investment term but is not mature enough to bottle can be sold to other investors or a bottler who will hold it or re-rack it to boost the flavour for bottling. There is always an exit for whisky, choosing the correct one to gain the best value is important. Being able to be flexible in holding and selling will ultimately increase the performance of a portfolio and Cask Trade is best placed to help with these decisions.

What to avoid when building a diversified whisky portfolio

Buying bottles

It might be tempting to invest in whisky casually without any advice by buying bottles which are marketed as limited editions and give an impression of rarity. In reality, if you can buy a bottle of whisky at retail with ease, it is unlikely to be that rare. Bottles are notoriously difficult to invest in. Read our Bottle vs Cask article which considers the pros and cons of each type of investment.

Only considering popular distillery names

In the world of cask investments, there are some very solid names to invest in which will give, over time, sold returns. While these names are not bad investments, it is worth looking at the bigger picture of distilleries. When looking to diversify, including casks from smaller, niche distilleries which have great potential can give breadth to a good portfolio.

Not consulting industry experts

It must also be noted that with the popularity of cask investment growing, there are many sources of information and advice online. If you come across any form of AI or investment calculator promising returns, these should be treated with caution. Our Whisky Investment Calculator Guide goes into more detail about thoroughly researching your cask investment and sources if information you can trust.

How our tailored advice will help you build the best portfolio of whisky

At Cask Trade, our goal is to help you find the best casks to meet your needs. You will be assigned a personal account manager who can guide you through the investment process and draw up portfolio options. This process starts with a series of questions. How long is the investment for, how much will be invested and what are the expectations of the investment? If someone has high expectations and is willing to take on greater risk, then that will require a different portfolio than someone who wants a long term, low risk, solid return investment.

The other important factor which will determine getting the best out of a portfolio is how the exit from the investment is handled. A company like Cask Trade has many exits for casks which will get the best from the portfolio. Whether a cask is young, old, needing to be bottled, re-racked or held, we can help arrange the most suitable way to realise your profit or sell you cask back into the industry.

With the above factors to consider, advice will most likely be needed to create a diverse portfolio. Once the parameters of the investment are known, Cask Trade will find the right casks to fit your needs.

Get in touch

Not everyone has the budget or desire to build a portfolio immediately. If you want more information about choosing the right cask to get you started, read our Beginners Guide to Whisky Investment.