Bottle vs Cask Investment

Cask Trade

Bottle vs Cask Investment - Which Should I Choose?

Whisky investment is when whisky is bought and kept for a period of time, in the hope that its value will increase and it can be sold for profit. It is possible to invest in whisky in two ways, either by buying bottles or by buying casks of whisky. However, the two methods of investing hold different pros and cons which should be considered when deciding what whisky to purchase.

Table of contents

- What is whisky bottle investment?

- What is whisky cask investment?

- How do I decide which investment option is best for me?

- How does cask investment work with Cask Trade?

What is whisky bottle investment?

Investing in bottles can be a good option for some. However, bottled whisky holds value in a different way to cask whisky; once the liquid is bottled, it stops maturing and therefore the value does not increase with time. For a bottle's value to increase, it must have rarity and a demand from collectors and other investors wanting to buy it.

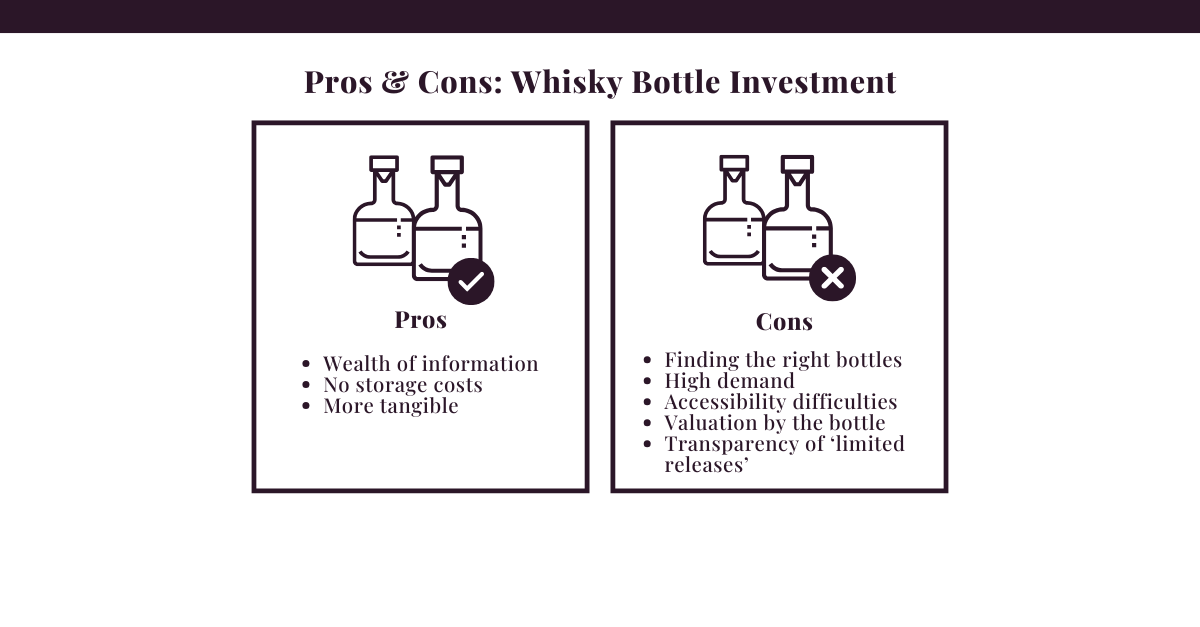

What are the pros of whisky bottle investment?

There are certainly advantages of whisky bottle investment. Firstly, the historical prices of bottles sold at auction and their initial retail prices can be easily found online, meaning there is a wealth of information to help buyers make their bottle choices. A good resource for historical prices at auction for whisky bottles is the Whisky Hunter website.

Another advantage to bottled whisky is no storage costs. While casks often require warehouse storage fees, this won’t apply to bottles as you can store your whisky collection at home.

Finally, bottles are a more tangible asset. They can be viewed and touched at any given time and, if the investment goals or decisions change, open and enjoyed!

What are the cons of whisky bottle investment?

The biggest problem with whisky bottle investment is finding the right bottles to invest in. If it is already desirable amongst investors, there will be high demand which can make acquiring sought after bottles difficult. The whisky valuation is determined only by the bottle investment market rather than a global whisky market, meaning trends in the cask marketplace don’t necessarily translate into bottle value.

The transparency of ‘limited releases’ may not always be clear. Many bottles are released as limited editions and seem investable, but the number of bottles in a limited release may not be divulged and not as limited as one might think. For example, in the past there have been ‘limited releases’ of up to 500,000 bottles. While the whisky itself may be good quality and from a desirable distiller, the higher number of bottles would impact desirability.

On the flip side, even if a bottle is part of a limited release which only has a few thousand or even a few hundred for a world market, the type of whisky or brand may not be collectable and therefore not investable. Deciding which are investable therefore requires knowledge of the bottle investment market.

Finally, accessibility to good bottles can also be difficult. When rare bottles are released for sale, they can be very hard to buy. A good history of buying through a particular retailer or having a relationship with a particular brand will almost always be needed. Many of the rarest bottles will be sold on allocation.

What is whisky cask investment?

Whisky cask investment is a form of alternative investment, where you buy a cask of whisky and hold it for a period of time to allow the liquid to age and mature. The maturation process increases the value of the whisky barrel investment, meaning unlike bottles, a cask’s value is linked to both the cask marketplace and the natural appreciation of the liquid.

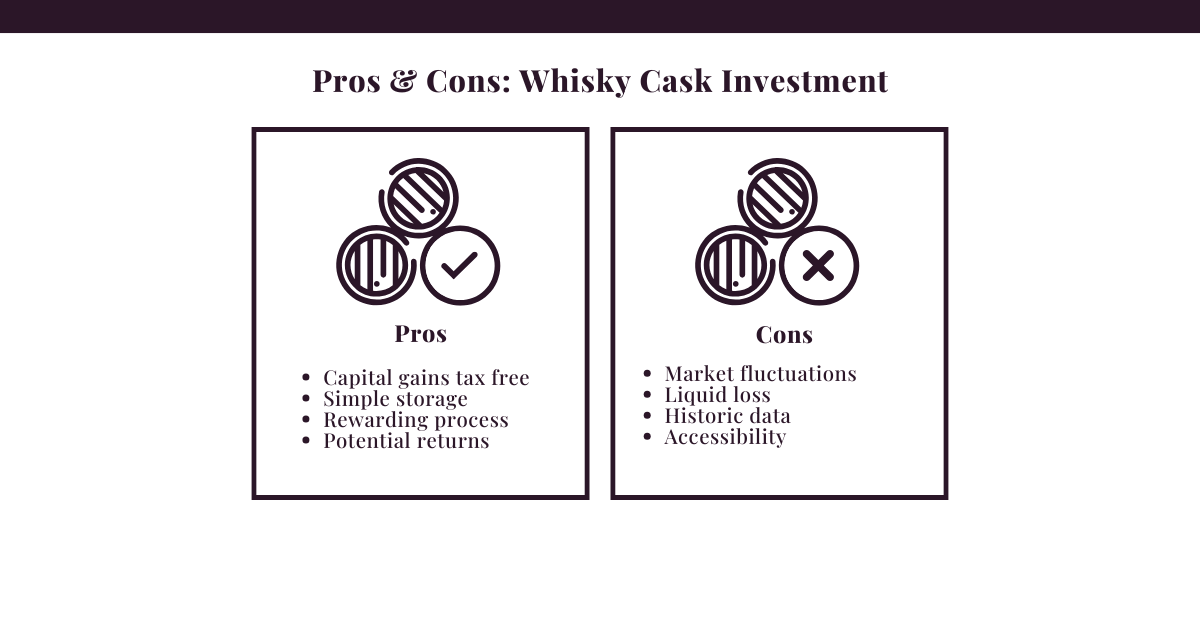

What are the pros of whisky cask investment?

Capital gains tax free

There are many pros to whisky cask investment. Firstly, there is no capital gains tax to pay on the sale of a whisky cask. While the aging process increases the cask’s value, whisky is considered a depreciating asset as it loses liquid over time through evaporation, therefore is exempt from capital gains tax in the UK. Those living outside of the UK should check their local tax rules.

Simple storage

Storage wise, whisky casks are held in bonded warehouses in Scotland, so there is no need to store the whisky cask yourself. While there is a fee, this tends to be around £50 a year meaning ‘extra’ costs are minimal.

Rewarding process

The process of owning a whisky cask can be a benefit to many investors. As it is a physical asset, it is possible to enjoy the liquid journey of a cask by sampling it at different ages. For the whisky enthusiast, this is a fulfilling journey over many years where you can see the liquid change and mature over time.

Potential returns

Finally, the investment potential in cask ownership can be a considerable pro. Like with any alternative asset, no-one can predict market trends. However, due to the natural appreciation of the liquid and historic market trends, whisky as an alternative asset has always performed well. That being said, long term potential should be considered over and above local or simple market trends.

What are the cons of whisky cask investment?

Deciding to invest in any alternate asset must be a considered process. If you are thinking about starting your cask ownership journey, it is important you research the potentials cons or risks associated with alternate investments.

Market fluctuations

As with all investment markets, no one can predict what will happen. There can be market fluctuations that may increase or decrease the value of your cask. These fluctuations don't just impact cask value but may also impact the demand for your cask. For example, if you own a cask from a lost distillery (shut down), this may boost the demand for the cask as it is rarer and therefore higher in value. On the other hand, if you have bought a cask of liquid that is relatively common on the market, this may negatively impact the desirability of your whisky, making it harder to sell.

Liquid loss

The fact that cask whisky is a physical asset can be a pro in many ways. However, it also means it could become damaged in rare situations. It is possible that the cask can leak and that loss of liquid is not covered by insurance. Another consideration is natural liquid loss over time, called the angels share. While every cask experiences this, you can risk losing too much liquid through evaporation without proper management and informed advice. Read more about the angels share in our article here.

Historic data

It is very difficult to track the value of whisky casks over time as there is no index for cask sales. This may change in the future as the whisky cask investment market matures and data is made available.

Accessibility

Finally, as the popularity of cask whisky rises, the more people there are on the market looking to sell whisky casks. Unfortunately, there are some unreputable companies out there, potentially selling at a much higher cost or falsely advertising casks. Researching the company to buy from is of the utmost importance.

How do I decide which investment option is best for me?

With so many pros and cons to weigh up, deciding the best whisky investment can feel like a big decision. This will mainly depend on your budget, goals, and investment hold time. The main difference in investing in bottles and casks is that bottles are much harder to buy the right ones to invest in and an investor needs to have a great deal of whisky knowledge. Without that knowledge, bottle investment can be risky.

However, if you decide that casks are the best route for you, experts such as ourselves can help you get started on your journey. This can open the door to whisky investment as the buyer does not need to be the expert to get involved, mitigating an element of risk when selecting their cask.

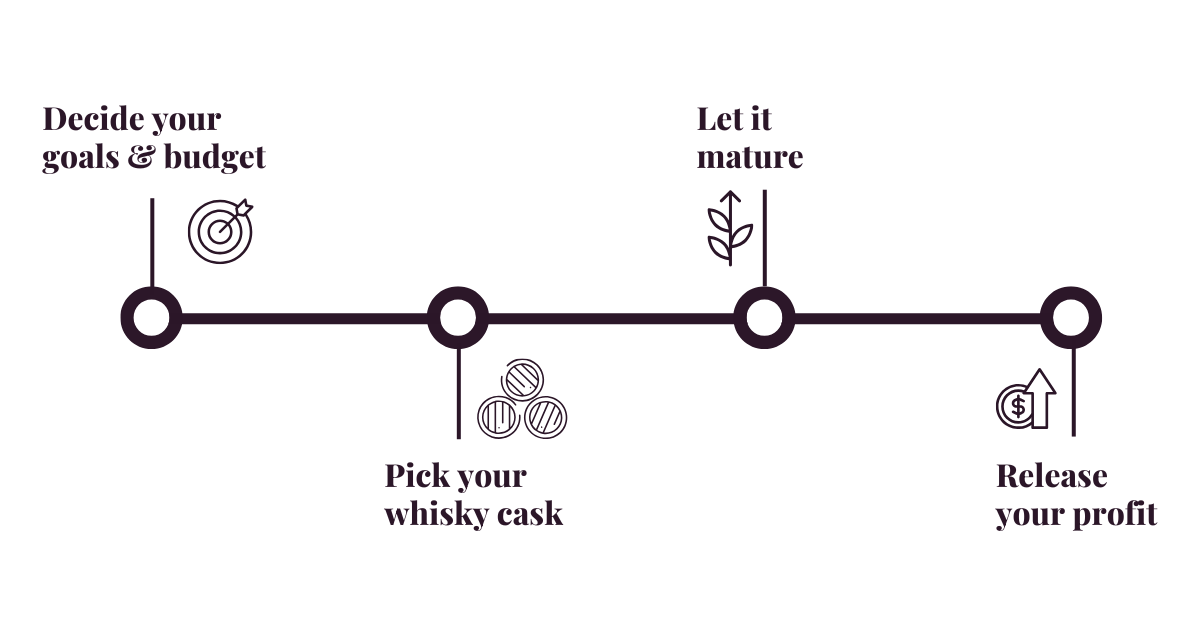

How does investment with Cask Trade work?

At Cask Trade, we help both private clients and trade clients, guiding you through every step of the cask investment process, end to end:

Decide on your goals and budget

Firstly, we help you define your goals. Are you purchasing for a return, or to bottle and enjoy at a later date? What is your budget? How long are you intending to hold you cask for? Are you looking for young spirit or something old and rare? There is no pressure for you to know the answers to all these questions. Our experts are here to help and can talk you though different options before you make a decision.

Review your portfolio

After defining the key questions above, your dedicated account manager will propose suitable cask options to meet your goals. This may be just one cask, or a portfolio of a few. Sometimes you may be advised to wait a couple of weeks or months, depending on what we know is coming onto the stocklist. The most important factor is finding the best option for you rather than rushing the process.

Buy your cask

Once you have decided on your cask, we will process the order for you. You will be required to sign the contract of sale, outlining our terms and conditions. Once this is processed you will be sent a link to pay via BACS or credit/debit card. On completion of payment, you will receive all relevant paperwork including your title transfer of ownership.

Be patient

Now it’s time to wait. Most casks we sell are longer term investments. Over the years there are certain measures that we take to ensure your cask is health checked, as well as offering the opportunity to sample your cask.

Samples usually take between 4-6 weeks and will usually cost between £50-£100 per sample. All samples are requested via your account manager. Depending on the age of your cask, you may wish to request a re-gauge at the same time as a sample. A re-gauge is simply a health check on the cask which will tell us the current litres of alcohol and ABV.

Enjoy your returns

When the time is right, we can help you sell your cask and realise profit or bottle it for your own use. There are a few options to do this:

- Auction Your Cask – this is our own cask auction site, allowing people to buy and sell whisky casks in 4 auctions annually.

- Private Sale – being experts in the industry, we might be able to help you connect your cask to someone if we know it meets their goals.

- Consignment – this means we put your cask back on our stocklist which goes out to our global network of cask investors and bottlers.

- Buyback – in some cases, we may be able to offer to purchase your cask back off you.

- Regent Street Cask Bottlers – if you are looking to enjoy the liquid yourself, or bottle for your own small business, we can guide you through the process with our own bottling service. Contact jessica@regentstreetcaskbottlers.com for more information.

Investing in bottles is much more difficult than investing in casks as it requires expertise and access to rare bottles, which is difficult. That’s not to say it can’t be done, but it is perhaps less suited to those without a strong background of whisky knowledge already.

If you are still considering cask whisky investment but want more information, read our Beginners Guide to Investing in Whisky where we discuss key considerations when looking to start your journey.

Alternatively, register to speak to our expert team. With decades of whisky knowledge, they are best placed to help you achieve your whisky goals.

Based in Hong Kong?

With experts across the globe, we can help you no matter where in the world you are. Register on casktrade.hk to speak to our Hong Kong based team.