Whisky Investment: A Beginner's Guide

Navigating the world of cask whisky can be daunting. At Cask Trade, we are here to support you every step of the way from cask selection through to exit options. Read our beginner's guide to whisky investment if you are interested in starting your cask ownership journey.

Cask Trade

Table of contents

- What is whisky investment?

- Why do people invest in whisky?

- Can I invest in whisky as a beginner?

- What whisky should I invest in?

- What is the investment process?

- How do I sell my cask?

What is whisky investment?

Whisky investment is a method of investing money into an alternative asset. Simply put, a whisky cask or bottle is bought with the intention of realising profit at a later date. At Cask Trade we sell whisky by the cask, meaning that our customers purchase casks which will be sold or bottled in a number of years’ time once the liquid inside the cask matures and appreciates in value.

Growing interest in the cask whisky market

Investing in whisky has grown in popularity and isn’t just reserved for those who drink the liquid. In a 2024 trends review, we commented on the fact that the market showed a peak in the first two quarters of 2022 before stabilising and then declining in 2023. This pattern aligns with the natural ageing process of casks and reflects its long-term investment potential. Like with any investment, there are peaks and troughs over time and the longer term picture should remain in focus.

The rewards and risks of investing in whisky

Whisky is considered an alternative investment with the possibility of higher returns being greater than those of traditional methods of investing. However, with greater return potential comes greater risk. As an entity, cask whisky naturally appreciates with age over time. That being said, the return potential must be considered alongside market trends, such as demand for the cask and the liquid’s rarity and provenance.

In this guide, we aim to cover multiple considerations and questions that we frequently answer when talking to new whisky investors. Get in touch with our expert team if you want to talk through cask ownership in more detail.

Why do people invest in whisky?

Investing in alternative assets is popular among those looking to diversify their investment portfolio. Just like art, cars, and watches, whisky can be an incredibly personal choice which is driven by an individual’s taste and interest just as much as financial considerations.

Whisky as a passion

For some, whisky investment is about the journey. Whether the buyer is passionate about the liquid or has family connections to certain distilleries, the process of purchasing a cask is driven by their unique taste and interests. For these such customers, the cask is often saved to mature to a specific age before being bottled for personal enjoyment or celebration, such as a wedding or anniversary.

Whisky as an investment

For others, the potential for return on investment drives the cask ownership journey. Passion and investment are not mutually exclusive and often cross over. However, it is not uncommon for cask owners to select their whisky based off market trends and cask provenance rather than pursuing their specific taste. For these investors, casks are more likely to be sold back into the whisky market via a number of avenues such as independent bottlers, auction sites, or to another investor.

Understanding the market

Ultimately, understanding market trends will influence the buyer’s decision to start their cask ownership journey. Whisky is a long hold investment, therefore recognising short term and long term trends is essential when making investment decisions.

Can I invest in whisky as a beginner?

It can be equally daunting and exciting for a beginner to invest in whisky. While every whisky cask investment is unique, there are a few considerations that we consider best practice at Cask Trade.

Research your whisky

Firstly, doing your own research will help you determine what kind of whisky you want. For example, reading up on different types of whisky casks may help influence what you will pick if you are looking to enjoy the whisky yourself. Each cask size and type will influence the maturation and taste of the liquid inside. For example, a sherry cask and bourbon cask will impact the flavour of the liquid differently.

Once you start looking at casks on the market, you will also notice many different distillery names. A lesser known fact is that some casks are not sold with naming rights, which could negatively impact profit later down the line. For more information about the nuances of naming rights, read our guide here.

Define your goals and budget

Are you looking to bottle or sell on? Do you want a shot term hold or a long term hold? Do you care about drinking the whisky yourself or is profit more important? Deciding what your cask journey looks like is a great way to refine what kind of casks you invest in. For example, a new make cask (under 3 years old) will likely be cheaper but need holding for a longer time before it is ready to sell or bottle. Alternatively, an older cask will be ready to sell on for bottling sooner, but you will have to spend more money on this.

Whether you know what you want or need some guidance, the team at Cask Trade are here to help you understand market trends, meet your goals, and match you with the right cask.

What whisky should I invest in?

Whisky can come in many forms and stages at which it can be invested in. Whatever you choose should align with your budget and investment goals. Two key factors to consider are whisky type (bottles or casks), and hold time.

Bottled whisky or cask whisky?

Casks and bottles offer different benefits when it comes to investing or collecting. While the right bottles could be profitable to re-sell, it is a collector’s market rather than investment. Once whisky is bottled, the ageing process stops, therefore the liquid itself will not increase in value. Value changes will be driven by market fluctuations in relation to the distillery, brand, or bottle scarcity. Casks, on the other hand, continue to age and mature beyond the point of sale, for as long as they are kept in the wooden barrel.

Short hold whisky investment

For casks, length of hold is a key consideration. Whisky can be bought at any age, from newly filled casks, through to casks which are ready to bottle. A short-hold investment in whisky is considered 5 years. If a whisky is bought at ten years old and then sold at fifteen, this would be considered a short-term investment and a sensible age to have bought the whisky. Short term holds may be beneficial if you are looking to sell to bottle at a specific age or enjoy the whisky yourself. However, buying a newly filled cask and selling it at five years old will be more susceptible to market fluctuations as the whisky will not be at an age to be bottled, and therefore only cask market conditions will be important, rather than the whole of the whisky market.

Long hold whisky investment

A long-term investment in whisky is considered ten years or more. The age of the whisky when bought is always a consideration, and more so when buying for a long hold due to the aging process of a cask. It is important to remember that whisky does have a shelf life and at some point the impact of the cask overpowers the spirit, meaning it is no longer good for bottling.

Over long periods of time, whisky casks also lose alcohol, which is known as the ‘angels share’. For the liquid to be considered whisky, the % of alcohol needs to be greater than 40%. A cask of whisky which is already below 50% when bought has a greater chance of becoming “underproof” than a cask bought at an alcohol level in the high 50’s%.

Due to these reasons, care must be taken when choosing a whisky for long hold, especially if the cask is already older. Read more on our blog about whisky maturation and how these factors impact a cask’s worth.

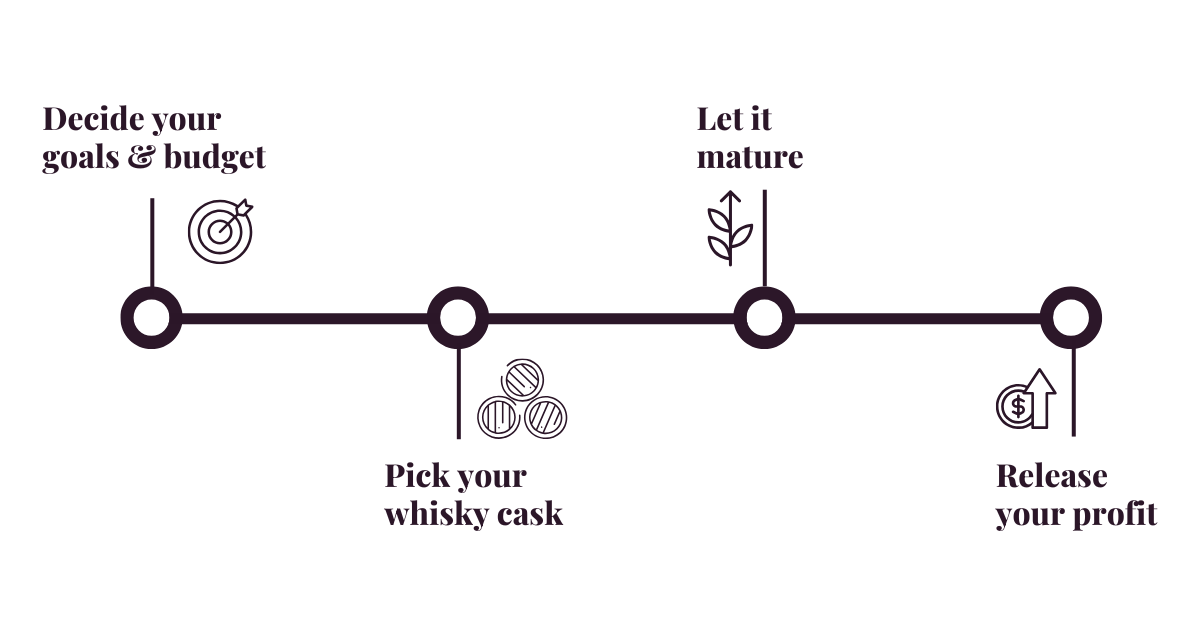

What is the whisky investment process?

Once you have decided that cask ownership is for you, how do you start investing in whisky? At Cask Trade, we guide you through the process end to end. While every customer is different, the below outlines the key steps to consider.

Decide you goals and budget

Before investing in either bottles or casks, deciding how much you can invest is paramount. This will help the decision on what type of whisky, the age of the whisky and the quantity. Like most investment portfolios, diversity is key. The greater the variation of whiskies in a portfolio the more resilient that portfolio will be to variations in the market.

Pick your whisky cask

Once a budget has been decided upon, the whisky can be chosen. At Cask Trade, our whisky experts can help you with portfolio strategies based on your budget. Would several younger casks be preferred to one older one? Which style of whisky is desired? Which brands might be seen to do well in the future? All these questions can be discussed at the point of choosing the right cask(s) to meet your goals.

Patience is key

By nature, whisky is a long-term business as the liquid takes time to mature. Therefore patience is needed for a number of years depending on the cask. Over this time, our team manage the maintenance of the cask. This includes valuations, as well as cask health checks (re-gauges) which ensures the alcohol % is monitored over the maturation process.

Release your profit

Releasing the profit from the investment is the last stage. Once your cask reaches the optimal age to be sold or bottled, there are several ways to 'exit’ the investment. Your account manager will be able to advise the best time to sell your cask based on market trends, your specific goals, and the health of your cask.

How do I sell my whisky cask?

Not only should you research the right time to sell your whisky, there are also a number of ways to realise profit. At Cask Trade, we can talk you through these options and help you understand when the market is best for you to sell your cask.

What is the right age to sell my whisky cask?

A whisky cask can be sold at any age. However, there are a few considerations which may impact the desirability of your cask. Whisky is traditionally drunk at specific ages, for example 12 and 15 and 18. If you look around in shops, you wouldn’t tend to see a 13- or 17-year-old whisky on the market very often. These milestone years can therefore be good benchmarks to look out for.

When you are ready to sell, it is recommended to re-gauge your cask for an accurate ABV (alcohol %) reading. Otherwise, we would recommend re-gauging at 10 years old, then every 5 years after. While this doesn’t need to be an annual check, maintaining an eye on ABV can help inform when your cask is ready to sell or bottle.

A combination of the age and alcohol % can help unlock multiple sale options. For example, a whisky which is twelve years old may well be good enough to bottle but could also continue to mature and create an older, even better whisky. With a cask in this position, the investor has the option to exit or to continue with the investment.

Consider market trends

As mentioned before, market trends must be considered. As with all markets there are fluctuations, and it will be less advantageous to sell a cask in a ‘down’ period of the market. With a long-term hold, these market variations will matter less, but if a cask can be held and sold after any market fluctuations this is preferable. There are also market trends which can be taken advantage of. For example, some brands hit higher popularity and selling casks of those brands at the height of a market can be profitable.

To keep up to date with whisky trends and insights, download our most recent market report, Beyond the Cask.

Whisky Exit Options

At Cask Trade, we offer in house five exits to our client being: bottling, auction, private sale arrangement, consignment, and potential to buy-back.

Bottle your whisky cask

Firstly, the whisky can be bottled. This can be done by the investor if they have a route to market for the bottles, or the cask can be sold to an independent bottler if the whisky is ready to be bottled. A good whisky cask company with contacts within the bottling trade should be able to facilitate this. If the whisky is not yet ready to be bottled and needs further maturation, the company who sold you the whisky should be able to find another investor to take the cask on the next stage of its life.

At Cask Trade, we have built a reputable marketplace. Not only do we have good relationships with independent bottlers, we also offer our own bottling service – Regent Street Cask Bottlers. Read more about our bespoke service here.

Auction Your Cask

A cask can also be put to auction, and there are a few companies able to do that including auctionyourcask.com, our sister company. Auction Your Cask was the world’s first cask auction platform. We run four auctions a year, allowing clients and new customers to sell their casks as well as bid on new casks.

Other routes back to market

In some cases, we may buy casks back to re-sell to market, or be taken on consignment to sell (meaning we help you sell your cask to our network and take an agreed % of the sale value). The important part of buying a cask is choosing a company who can exit you from your investment and return it to the market or have it bottled.

Start your whisky investment journey with Cask Trade

At Cask Trade, we pride ourselves on making whisky cask investment an accessible and enjoyable process. We have a team of whisky experts who hold a wealth of knowledge between them. Not only are they experts in the market, they have a true passion and understanding of the liquid.

Read our cask marketplace report

If you would like to learn more about the cask whisky marketplace, download a copy of Beyond the Cask, our annual whisky report.

Register to start your cask ownership journey

If you have decided that whisky cask ownership is for you, or want advice about how to get started building a portfolio, register today to speak to one of our experts. Once you register you will be assigned a dedicated account manager, gain access to our exclusive stocklist, and personalised advice and support.

Based in Hong Kong?

With experts across the globe, we can help you no matter where in the world you are. Register on casktrade.hk to speak to our Hong Kong based team.